CINcompass Resources

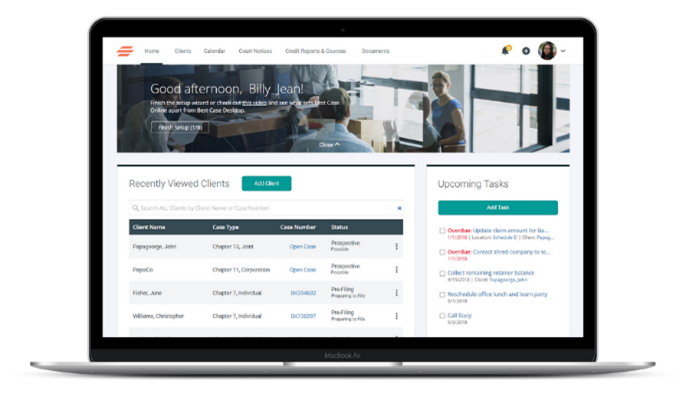

CINcompass has been replaced by Best Case cloud, the market-leading case-management software for case preparation and filing.

|

| Sign Up Now |

Important milestones related to your CINcompass account:

|

Transitioning to Best Case cloud is an easy process with streamlined tools, educational resources, and a Client Success Team to support you.

|

|

|

|

|

FAQ Review frequently asked questions on the sunset announcement and case migration to Best Case cloud. Download → |

Data Migration Watch this video tutorial and download our guide on how to import your CINcompass cases into Best Case cloud. Watch → |

Transition to BCC Webinar Watch our webinar to learn more information about Best Case cloud and the transition from CINcompass. Watch → |

Educational Webinars Basics of Best Case Cloud Learn More →

Client Portal Overview and Training Learn More → |

Ready to move to Best Case cloud?

SubscribeBest Case cloud annual subscriptions include Chapters 7, 11, and 13 federal and local forms, client portal, court notices and calendar, as well as software updates and unlimited support.

|

PricingAnnual subscribers can migrate to Best Case cloud under your current CINcompass contract and terms, regardless of the number of users in your firm. Monthly subscribers can lock in your current monthly rate for the next 12 months with a new annual contract and continue to pay month-to-month. |

Client Retention Resources:

| Email: | clientsuccess@stretto.com |

Technical Support Resources:

| Email: | bchelp@stretto.com |

| Online Support: | bestcase.com/support |

| Toll Free: | 800.492.8037 | 877.796.9882 |